Bending Assumptions: Model II and Quantile Regression

First, a note

- To see code, http://github.com/biol609/biol609.github.io/lectures

- Useful during “lab” so you don’t have to flip through slides

- .Rmd files, so will have to view “raw”

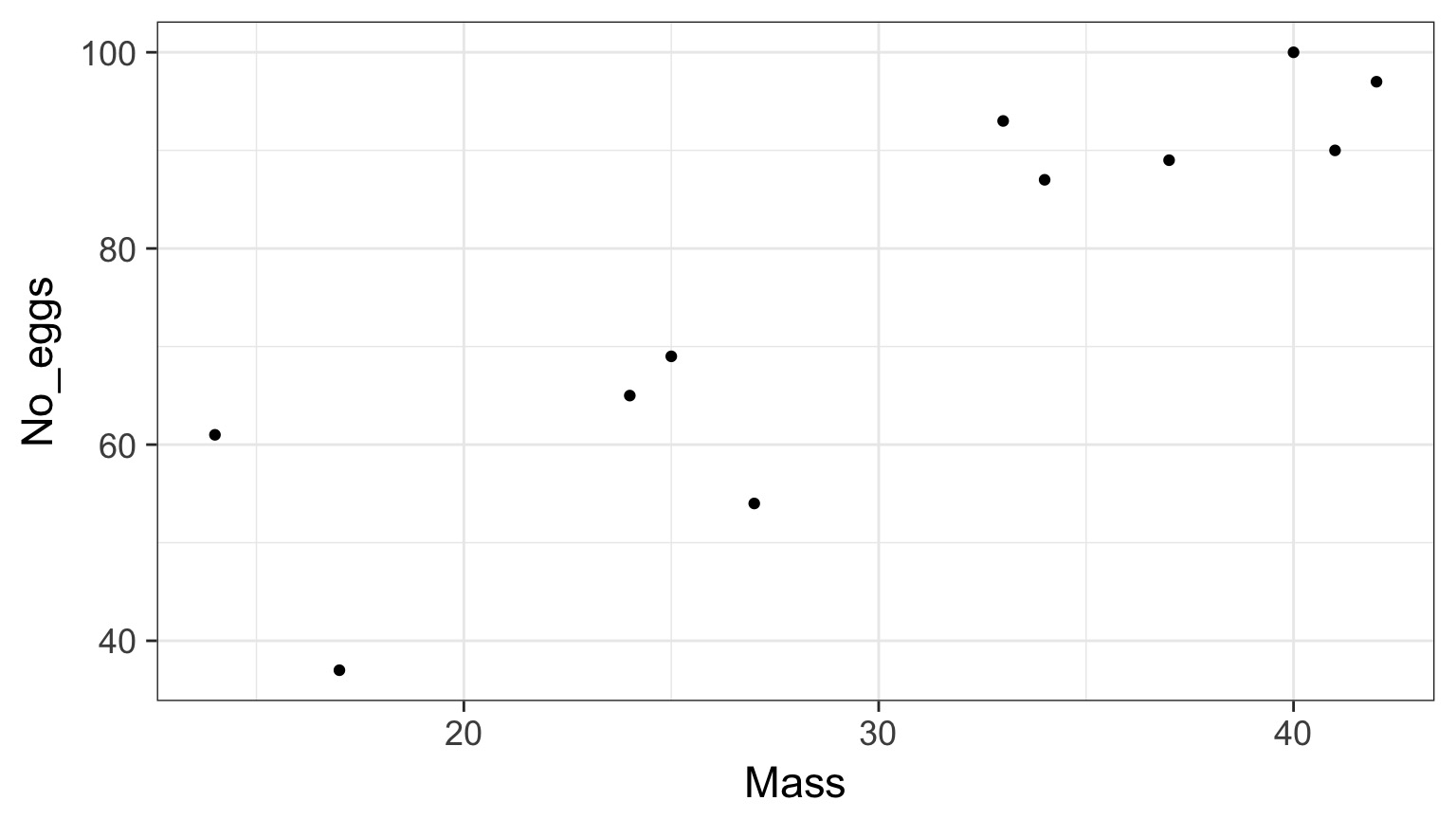

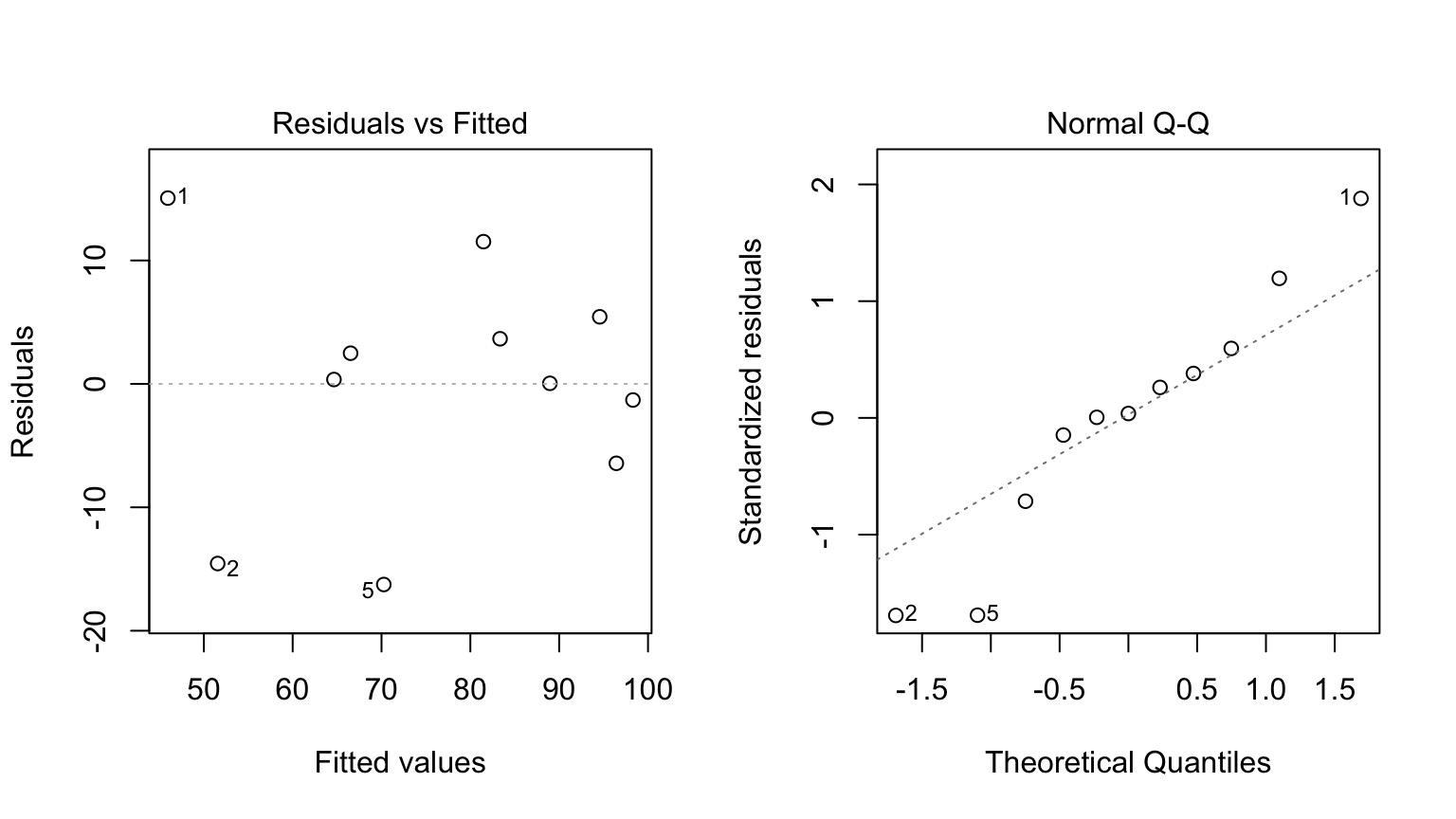

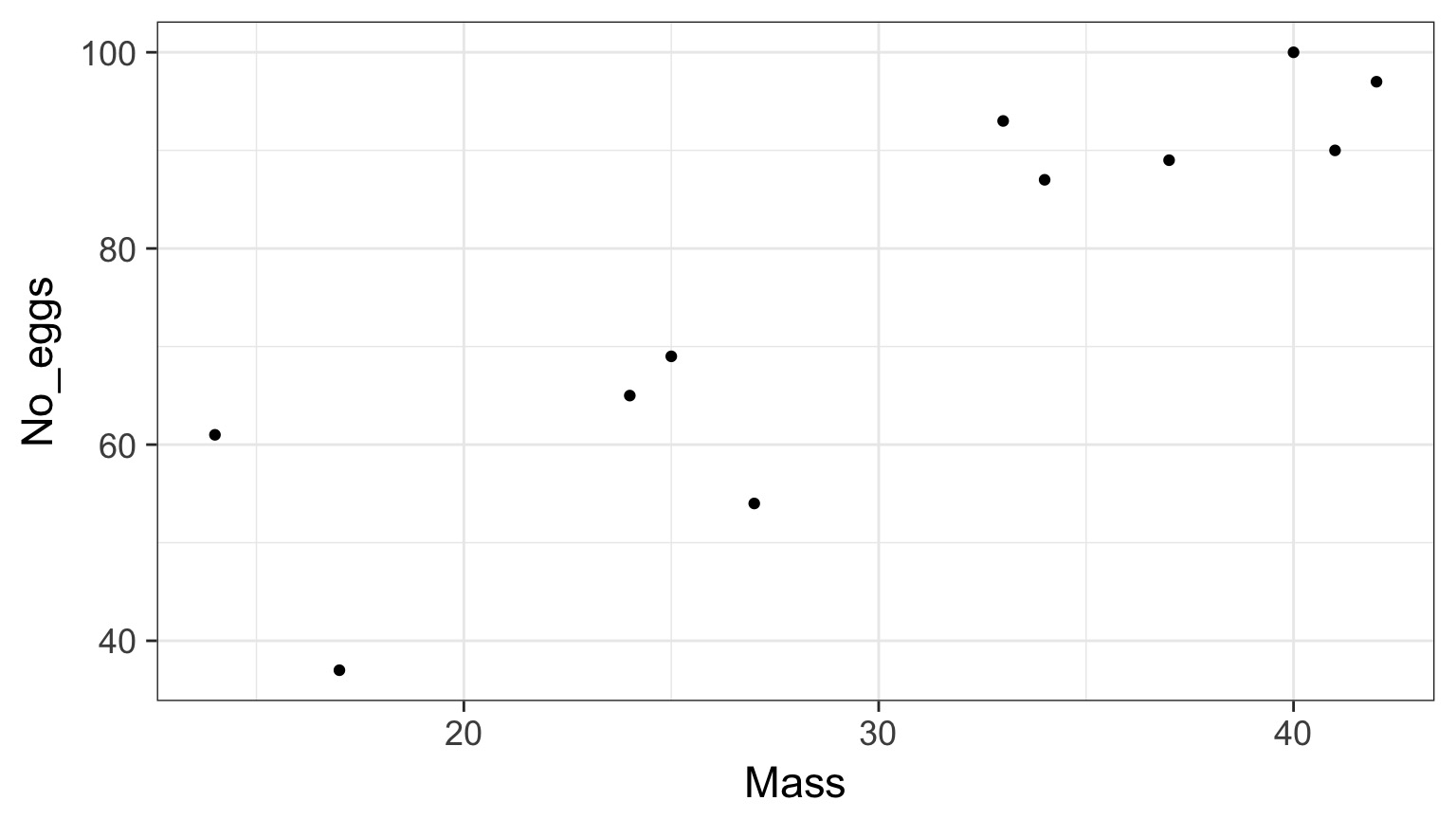

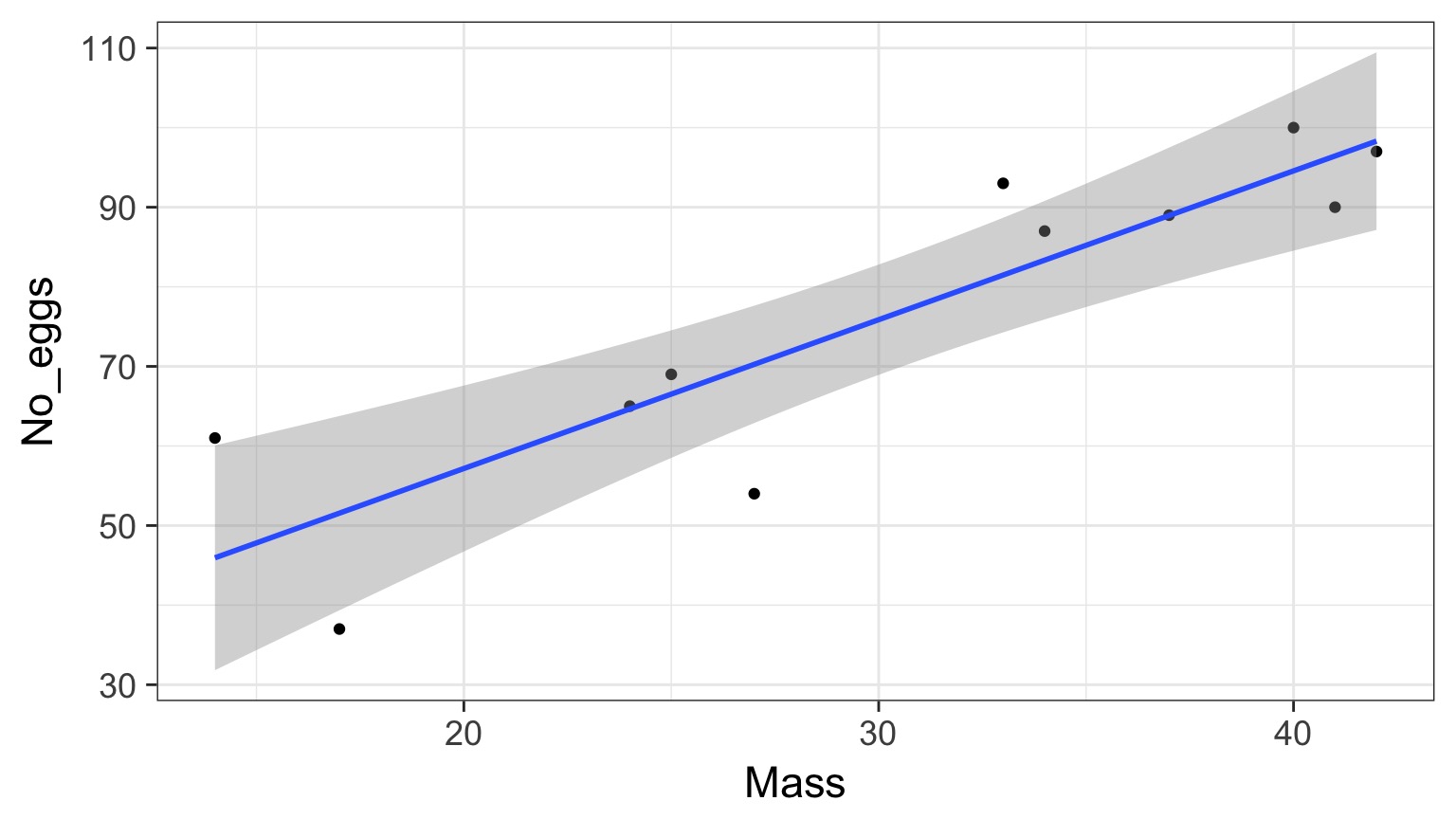

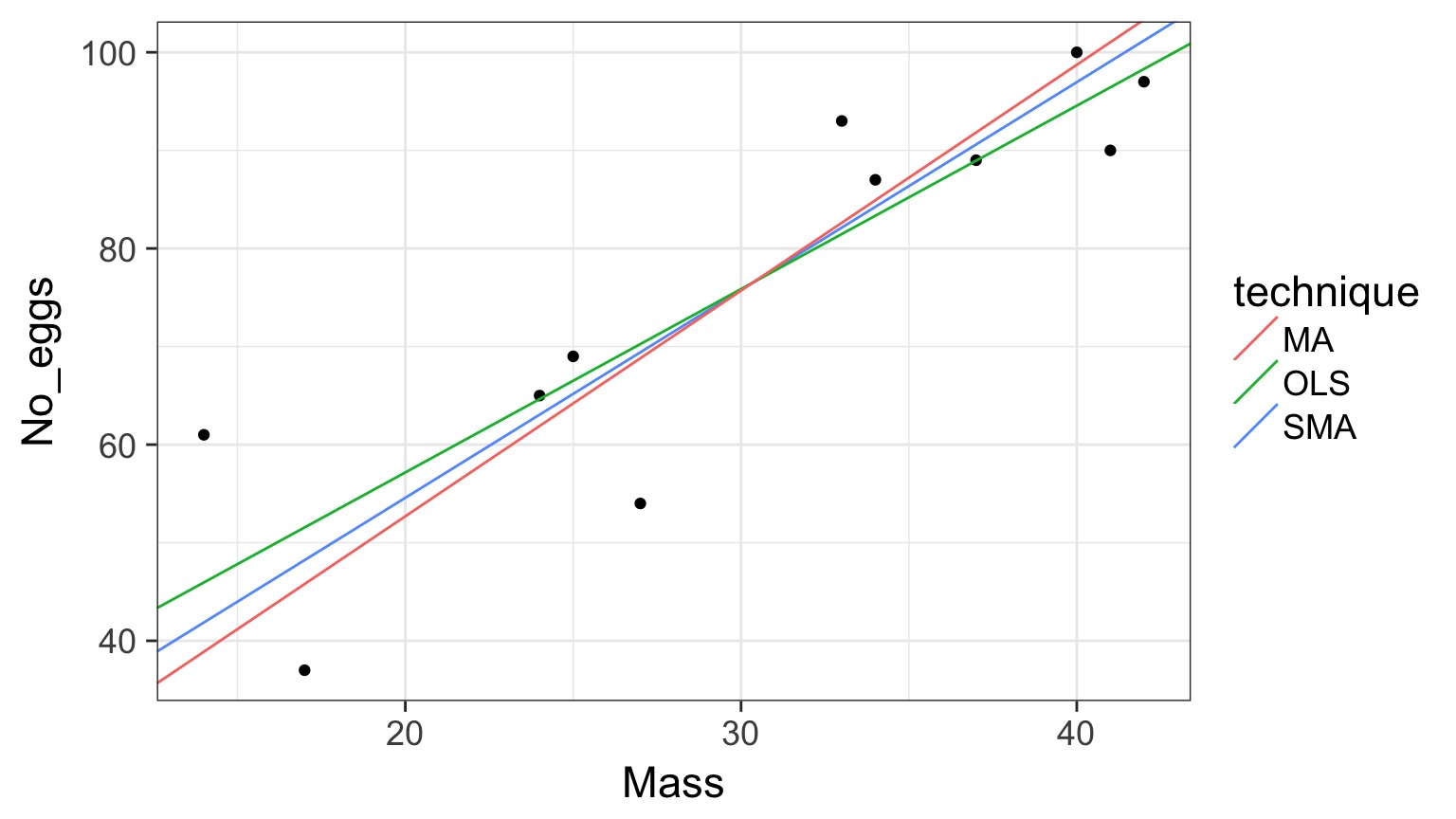

Sometimes Things seem OK: Cabezon Spawning Data

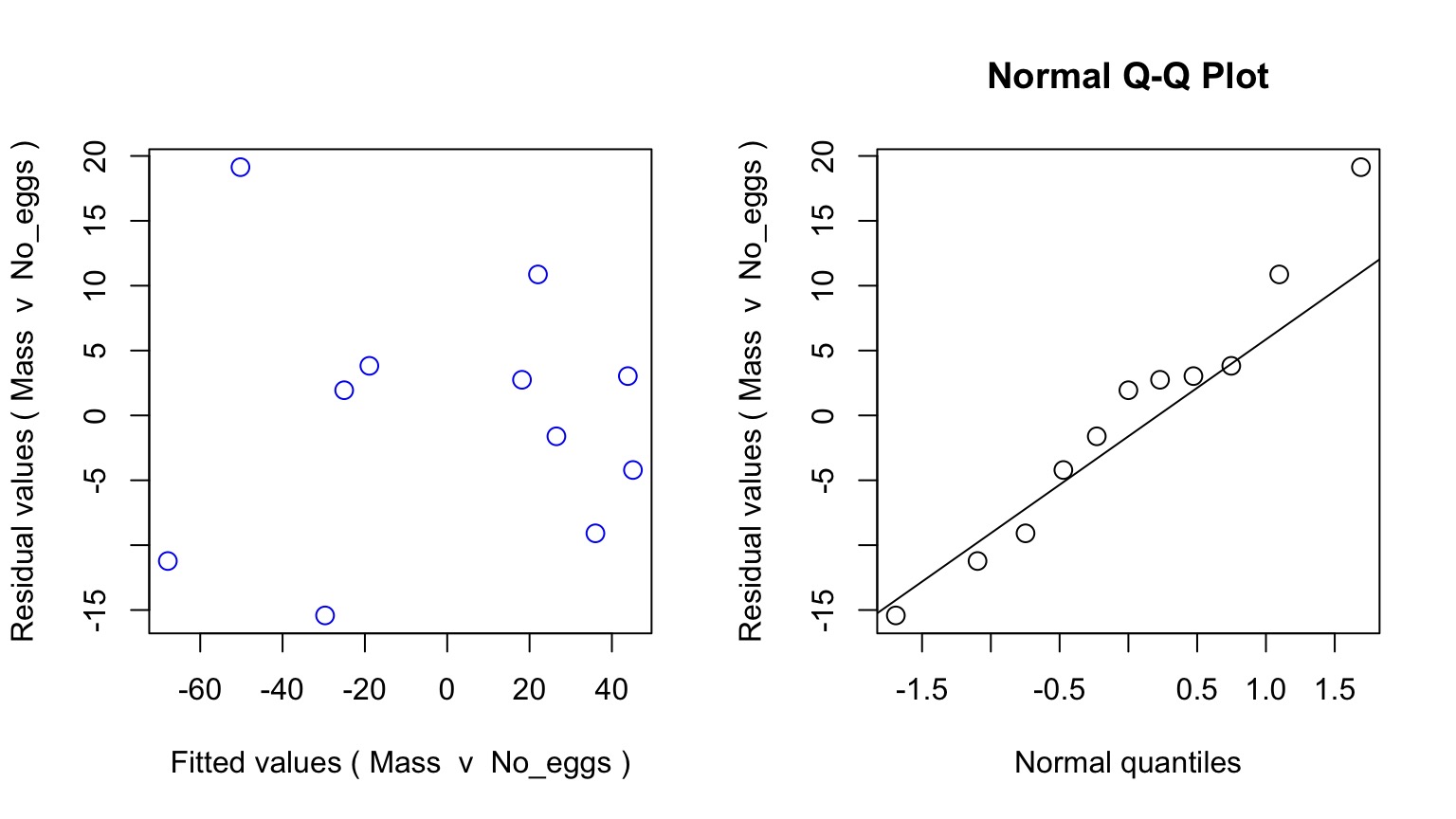

But - Those Residuals are Wide

What if I told you there is Error in the Mass measurements, too?

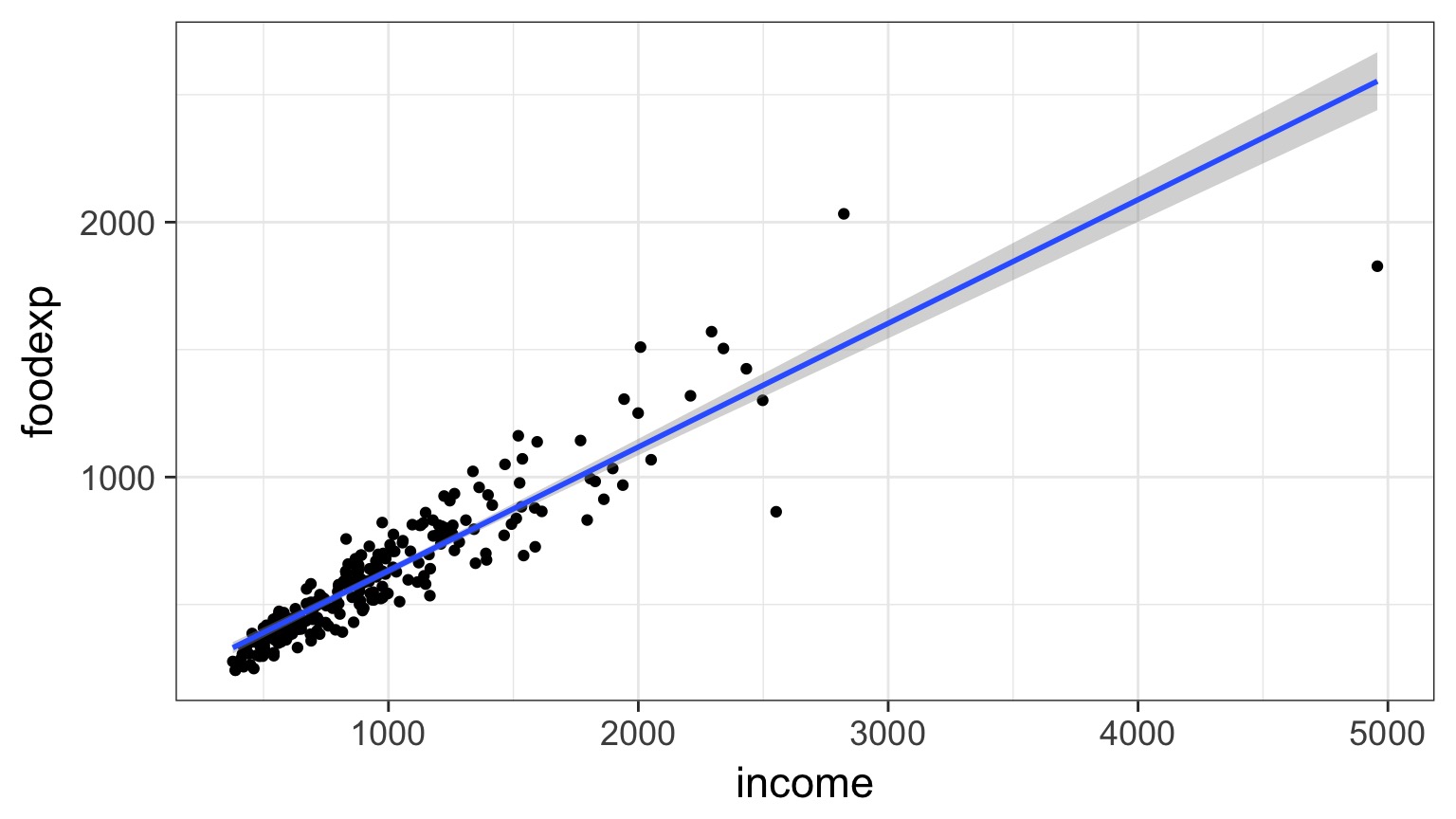

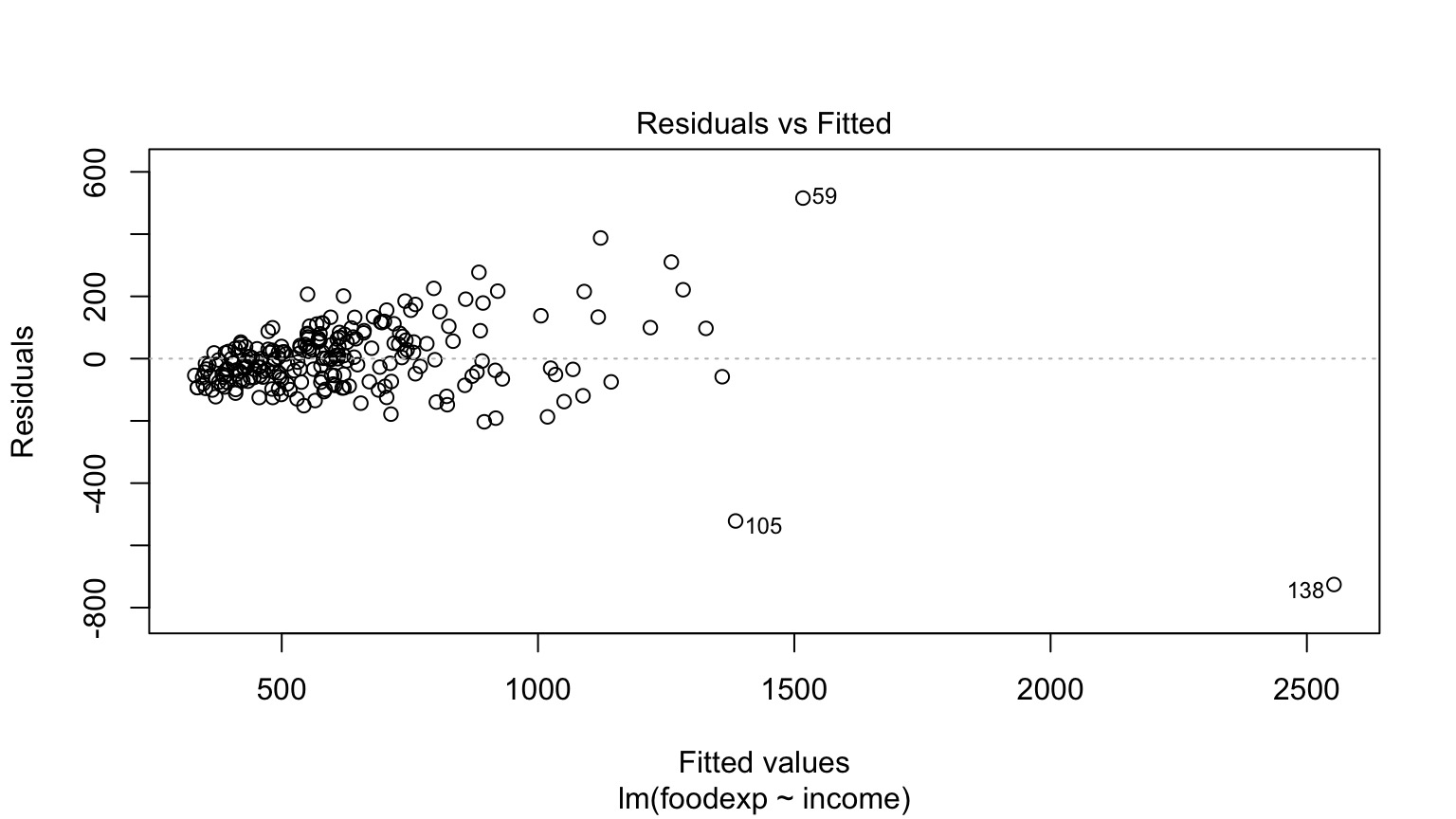

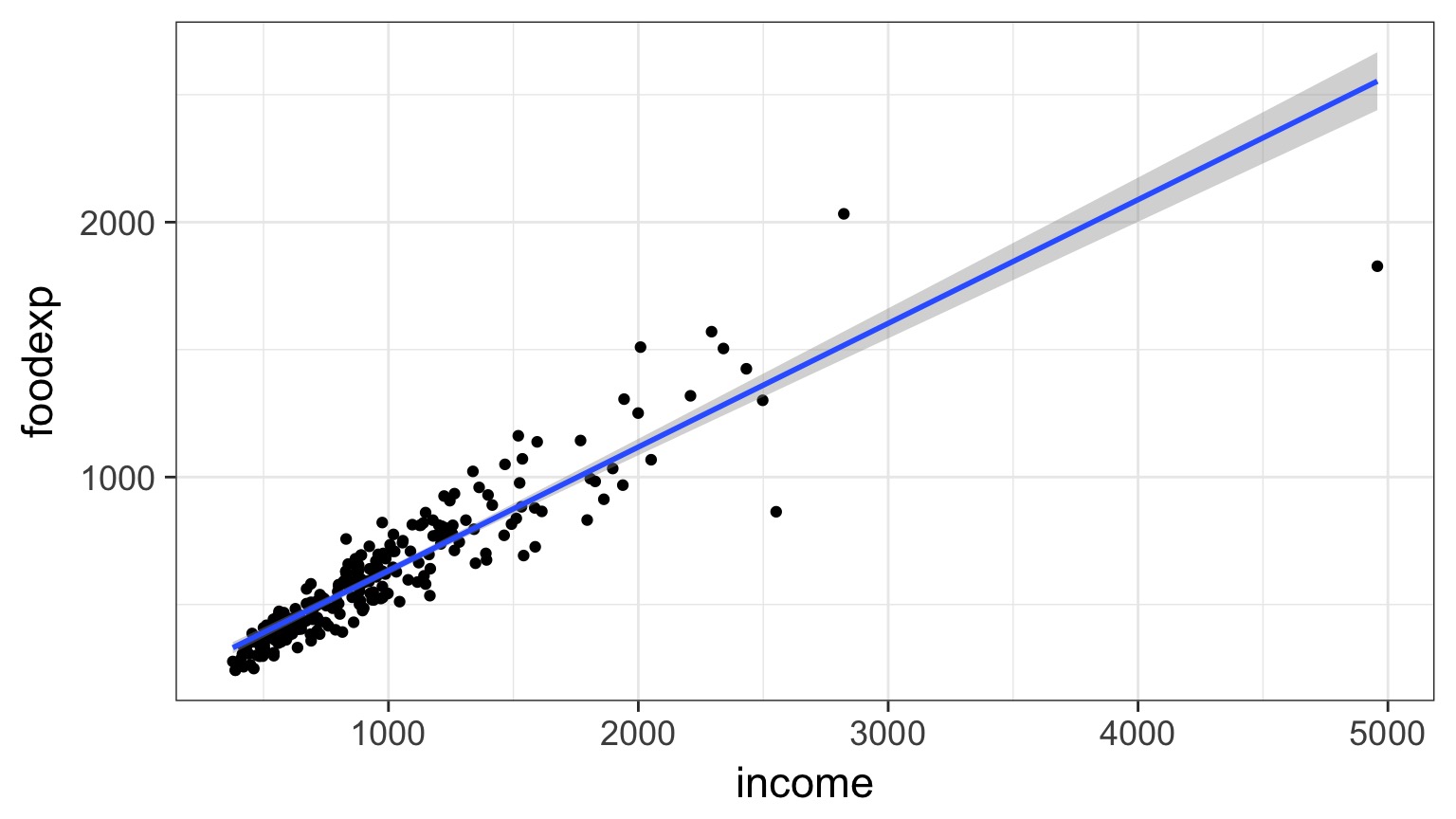

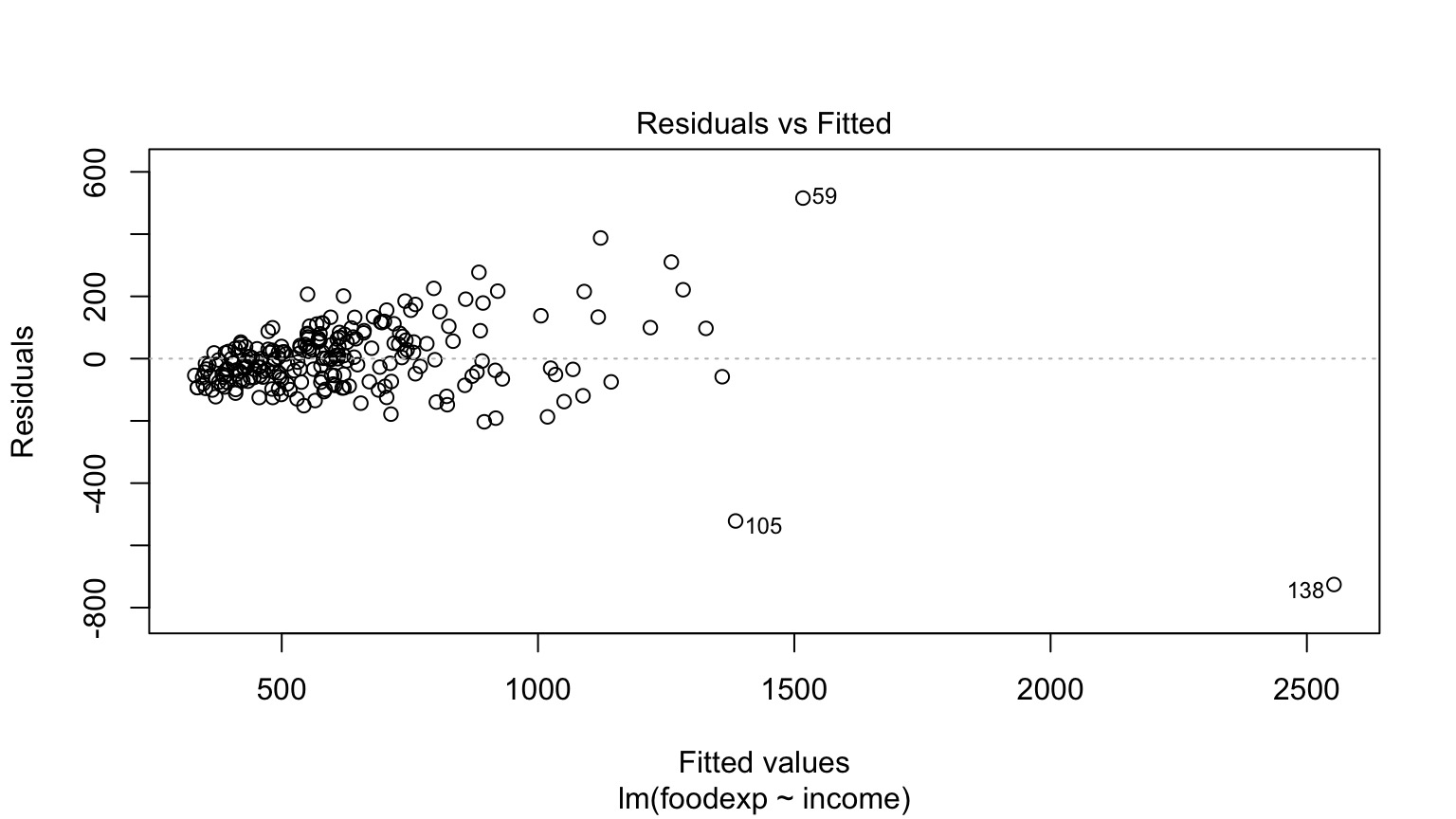

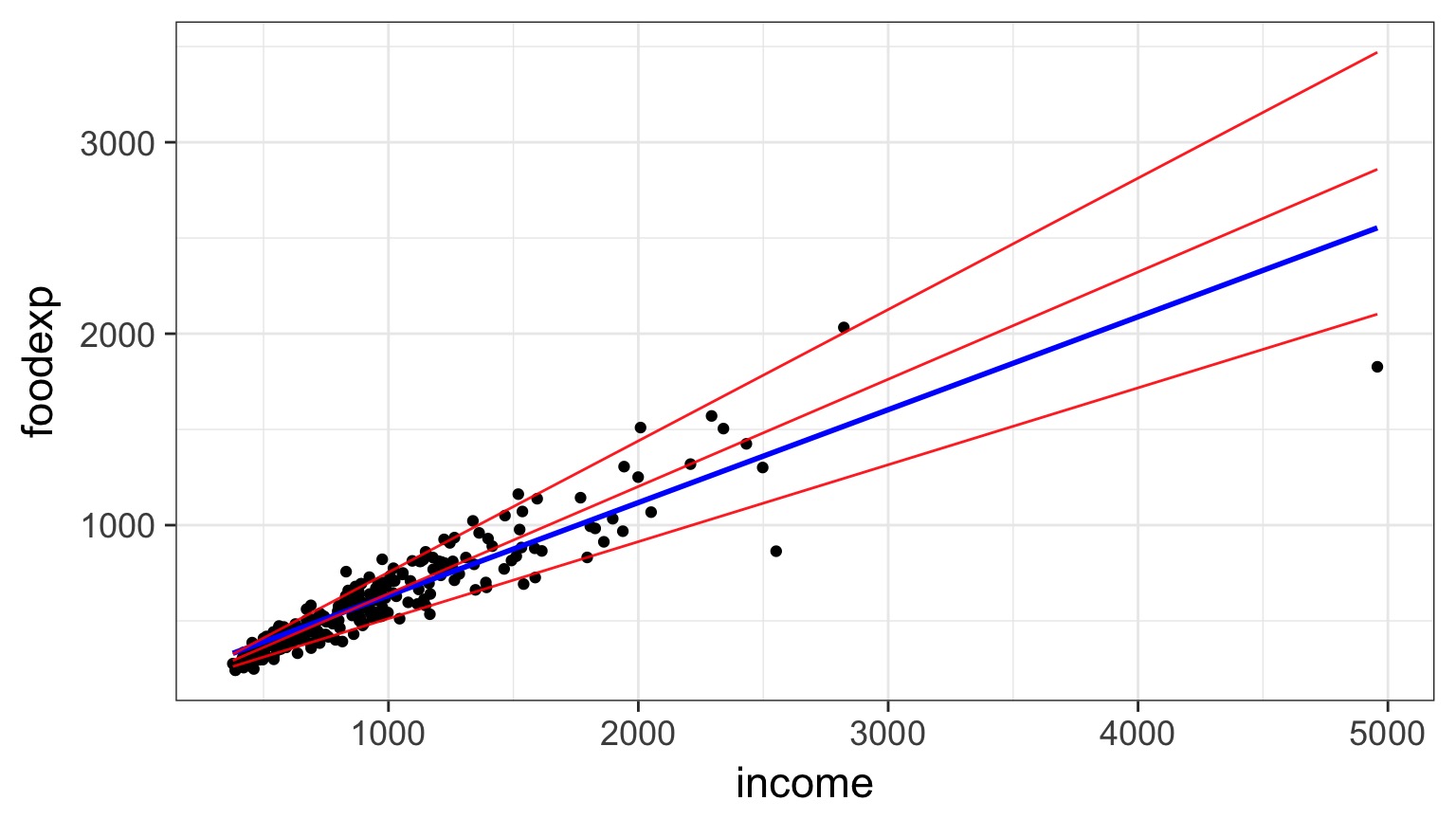

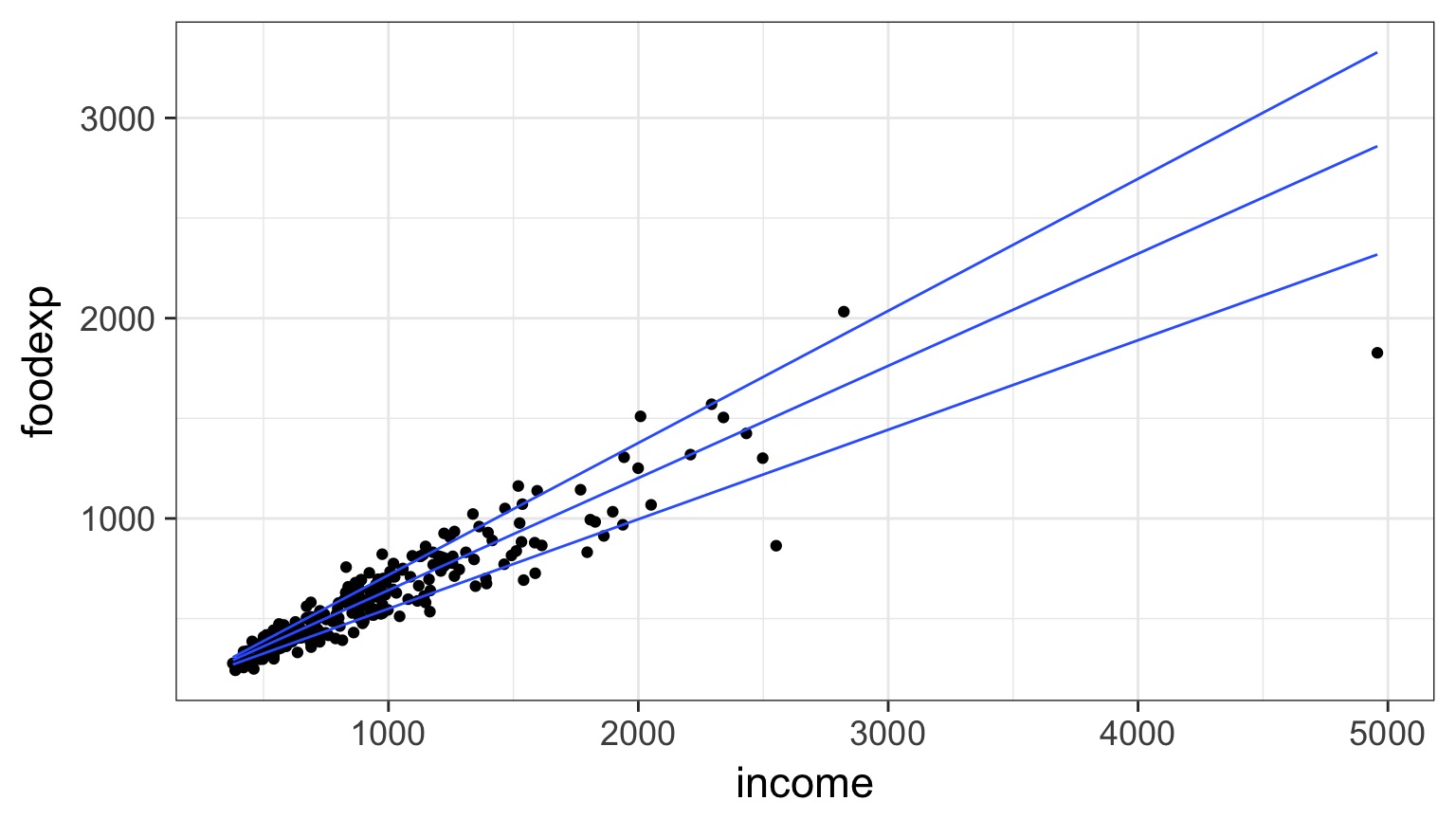

Food Expenditure by Income in Belgium

But - THE TRUMPET!

A Robust Outline

- Model II regression

- Quantile Regression

Thursday:

- Robust Regression

- Generalized Least Squares

Cabezon Spawning Data

Linear Model Fit

Assumption: Error Only in Y

But What if There is Error in X?

Can have big biasing effect on slope estimates

Really, Error in Both

Really, Error in Both

Model II Regression

- Estimates best line(s) describing relationship between X and Y with Error In Variables

- Assumes bivariate normal relationship

- Not for prediction (use OLS)

- But can compare slopes, intercepts between groups

Model II Regression: When?

- Uncertainty in X and Natural Error

- Common in Allometry

- Common in Power Law estimation

- But who doesn’t have that misbehaving scale…

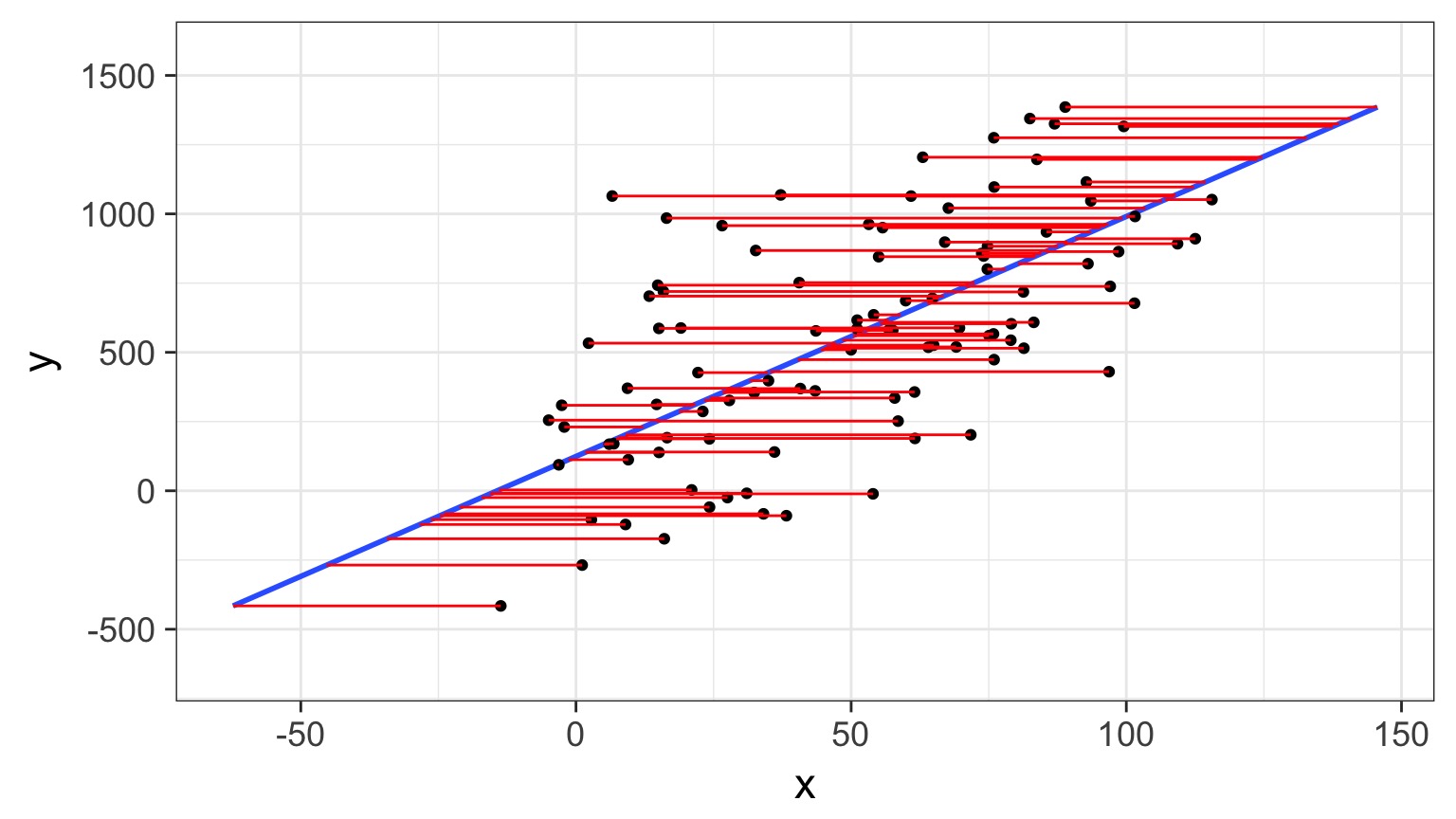

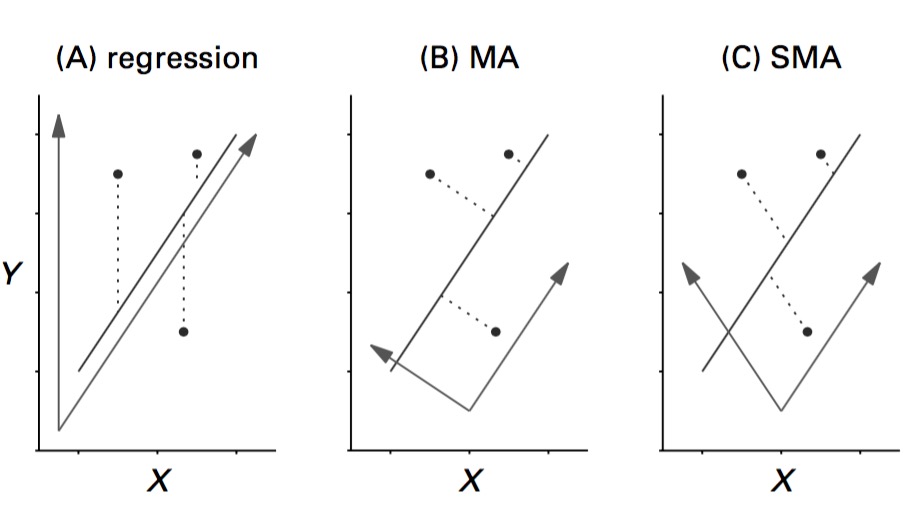

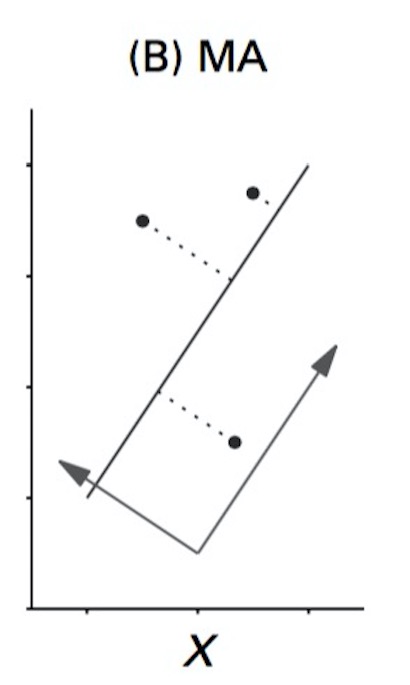

Major Axis Regression

- Minimizes sums of squares beetween line and points

- “Residuals” are perpendicular to fit line

- Variables should be on same scale

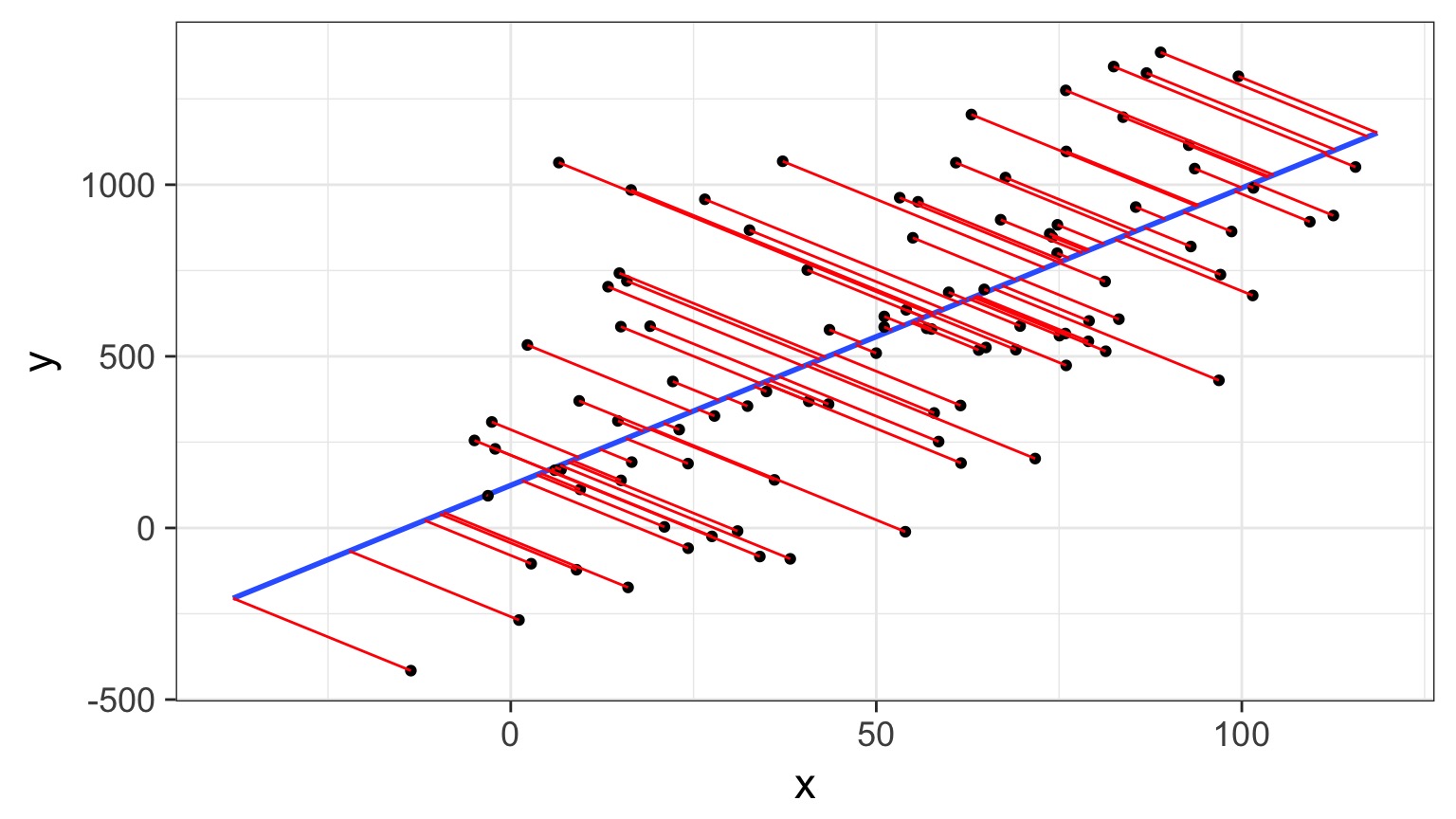

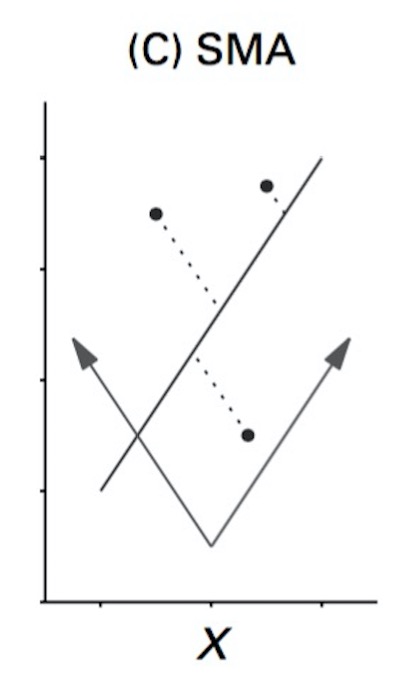

Standardized/Reduced Major Axis Regression

- Minimizes are of triangles with points as right-angle corner

- Variables need not be same scale

- So, think of it as doing an MA on rescaled variables

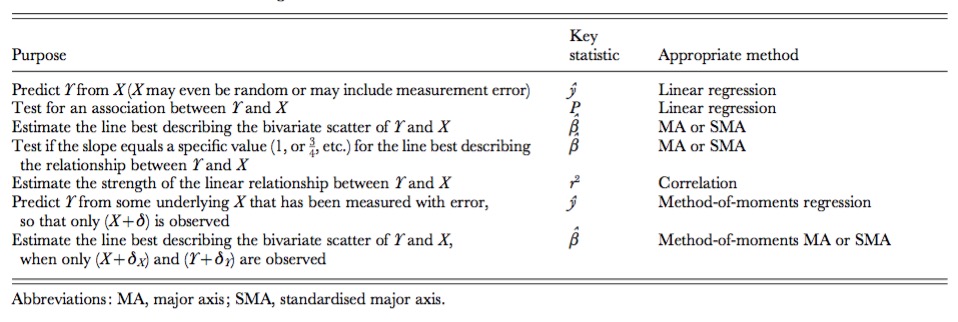

When to use what

Wharton et al. 2006

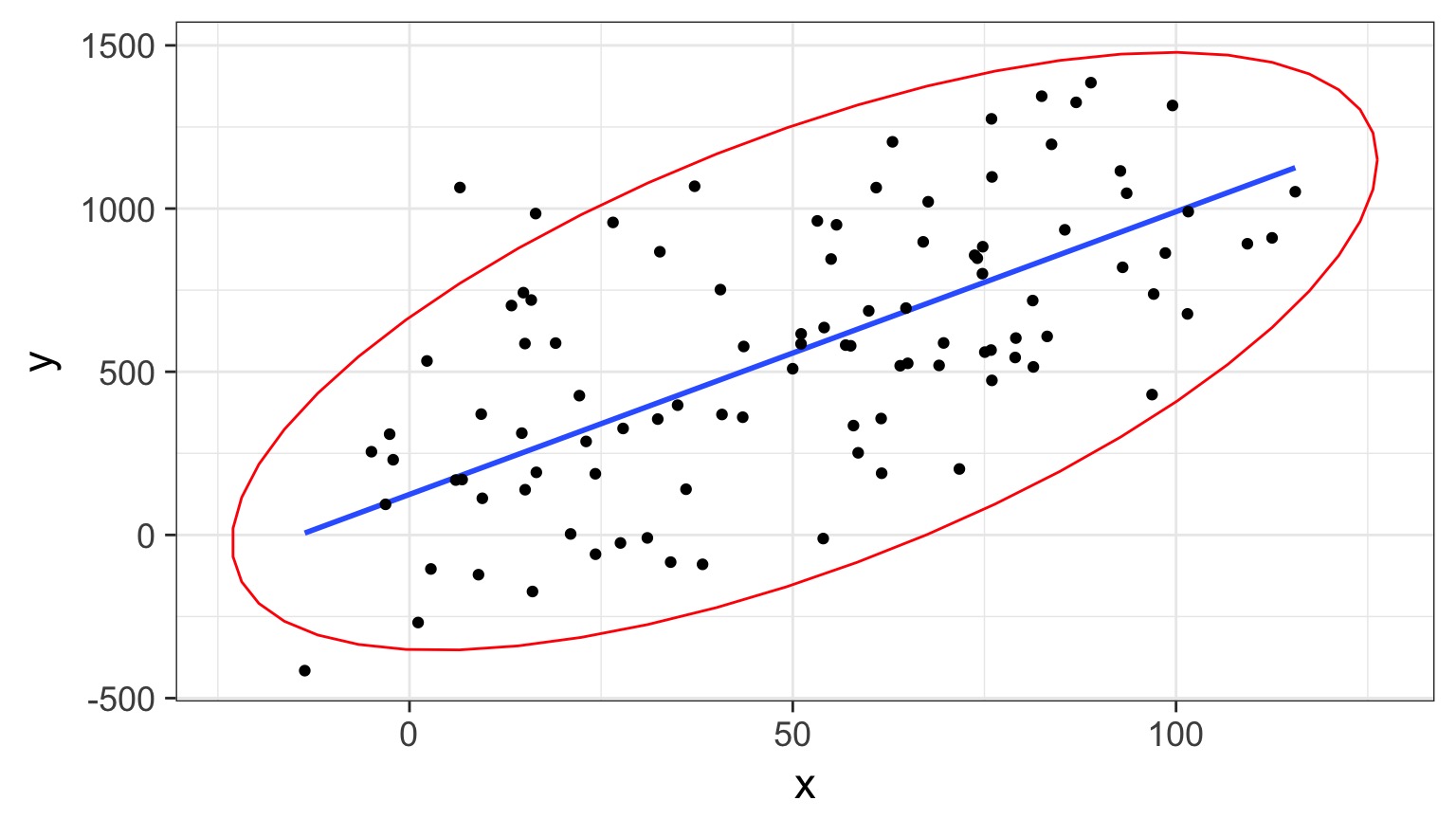

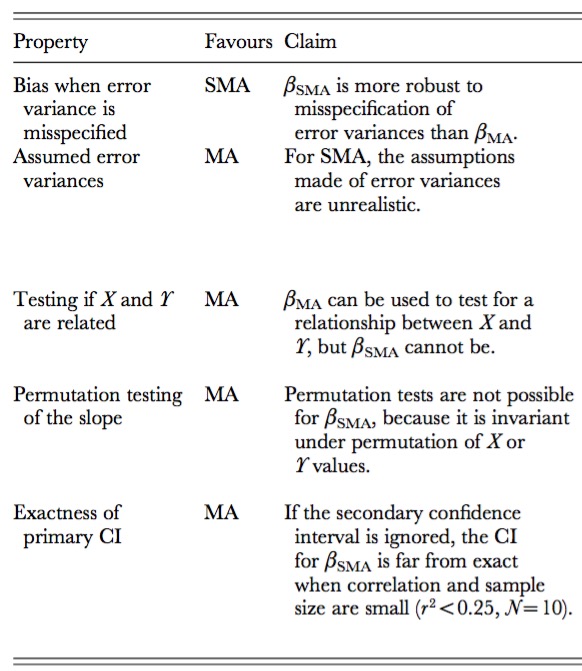

SMA v. MA

Wharton et al. 2006

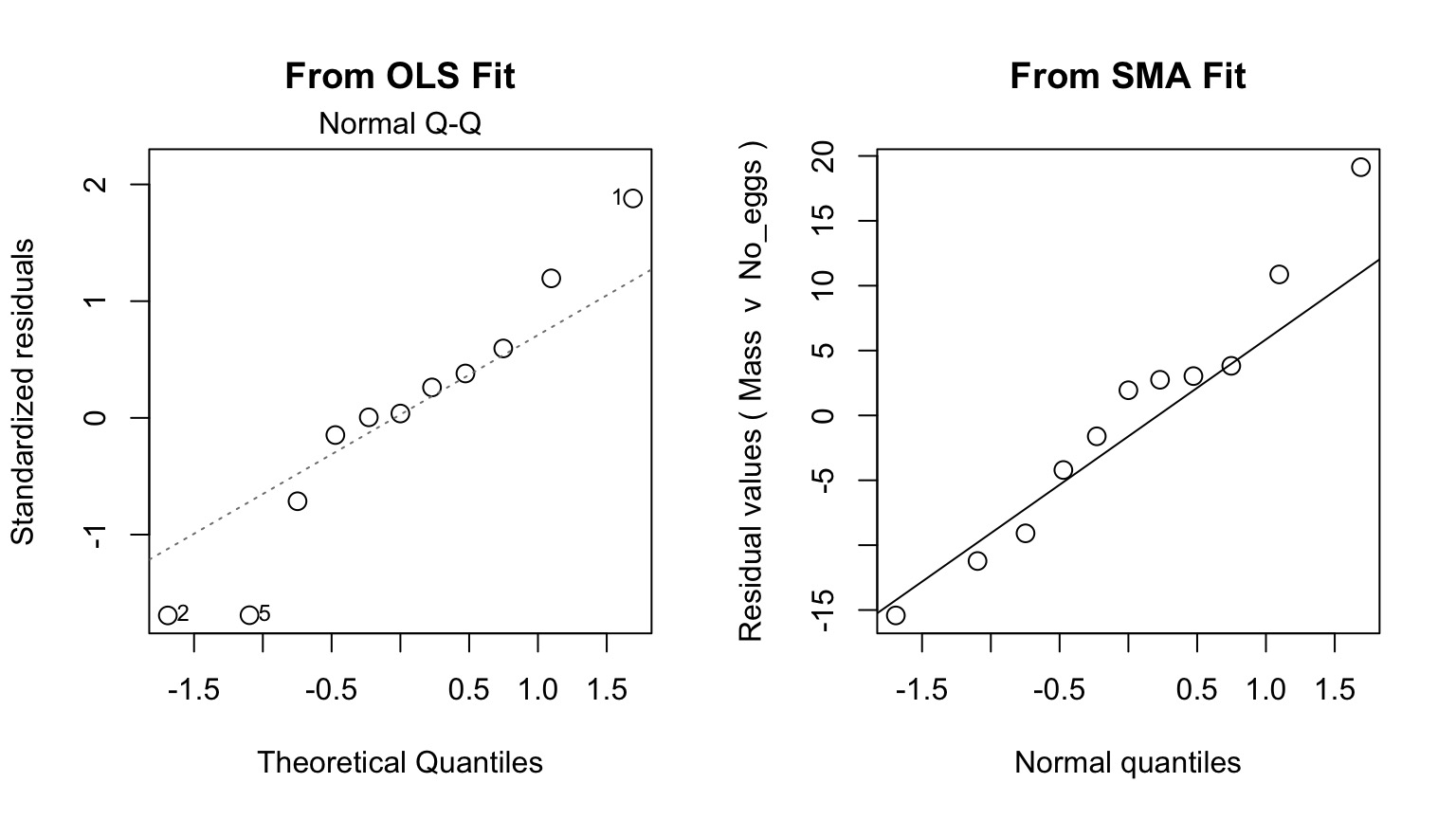

Fit with smatr

library(smatr)

cab_sma <- sma(No_eggs ~ Mass, data=eggs)Additional arguments:

method: SMA, MA, or OLS

type: for compring groups

robust: if outliers present

multcomp: TRUE to test multiple groupsWarton et al. 2012

Fit with smartr

Call: sma(formula = No_eggs ~ Mass, data = eggs)

Fit using Standardized Major Axis

------------------------------------------------------------

Coefficients:

elevation slope

estimate 12.19378 2.119366

lower limit -11.73415 1.496721

upper limit 36.12172 3.001037

H0 : variables uncorrelated

R-squared : 0.7784851

P-value : 0.00032417 Checking Assumptions

QQ Much Better Behaved

Comparison of Fits

A Robust Outline

- Model II regression

- Quantile Regression

Thursday:

- Robust Regression

- Generalized Least Squares

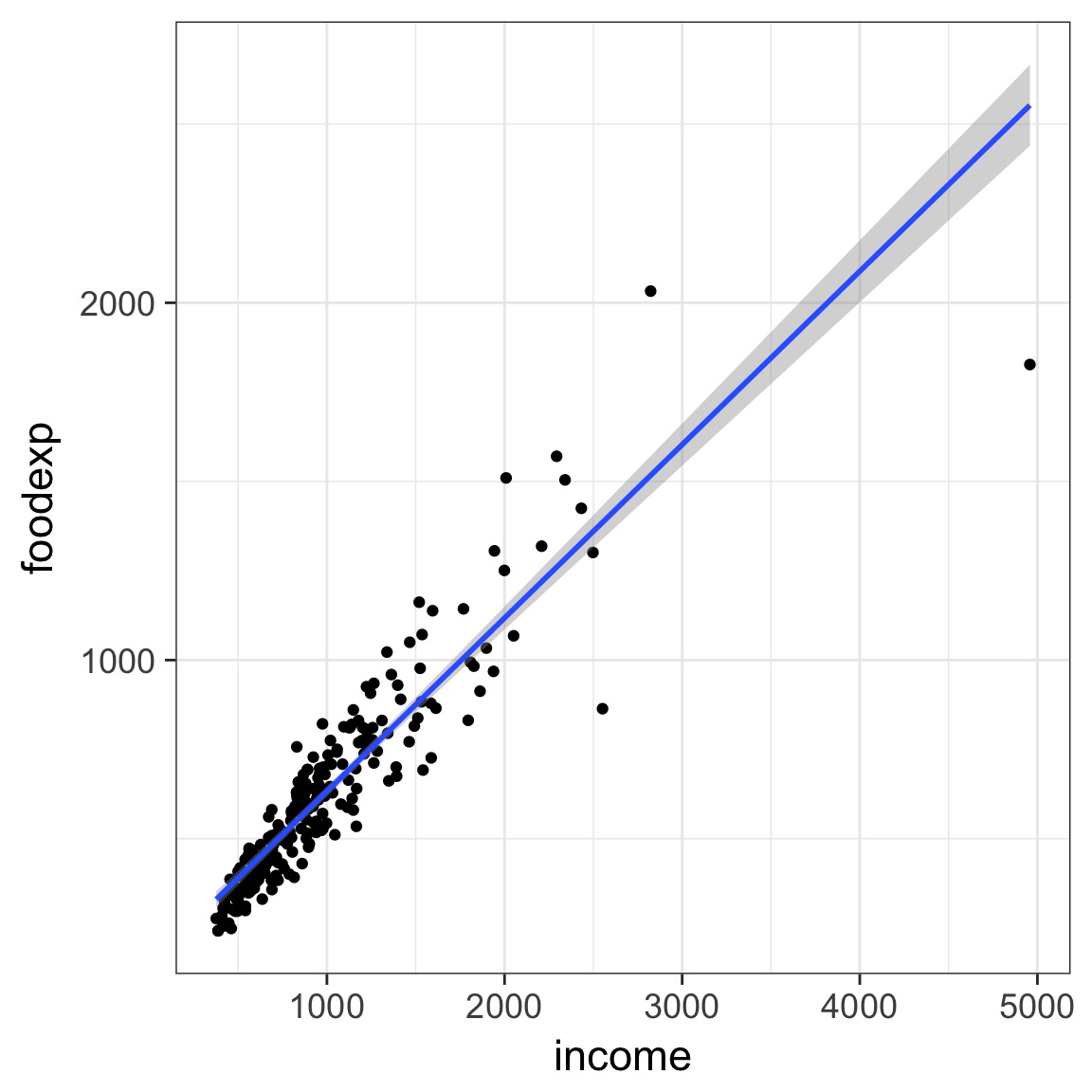

Food Expenditure by Income in Belgium

But - THE TRUMPET!

Regression Through the Mean

- Traditionally, we fit a regression through a mean

- \(\hat{y_i} = \beta x_i\) implies the mean value of y at x

- E[y|x]

- E[y|x]

- We can fit through other parts of the distribution

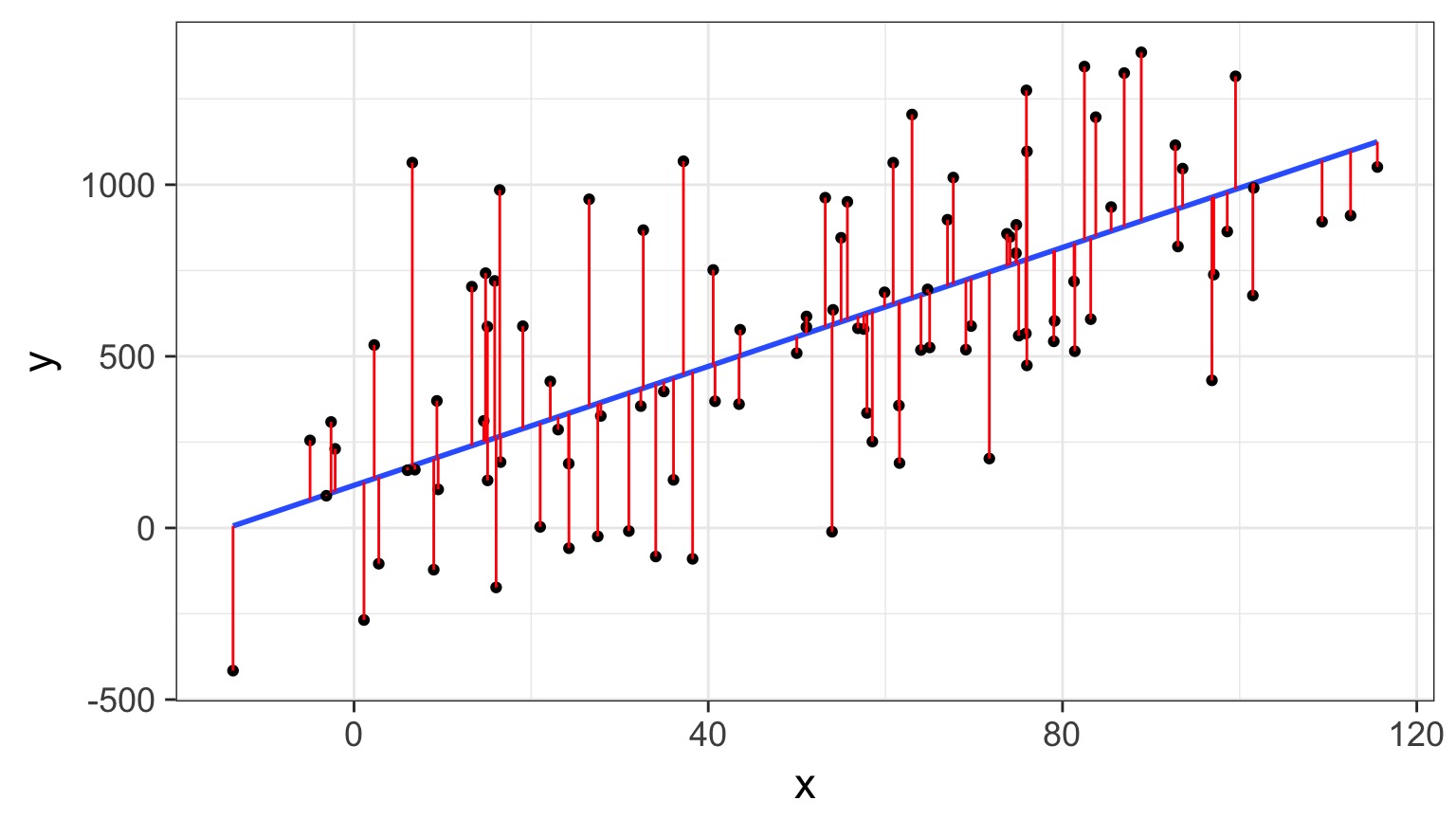

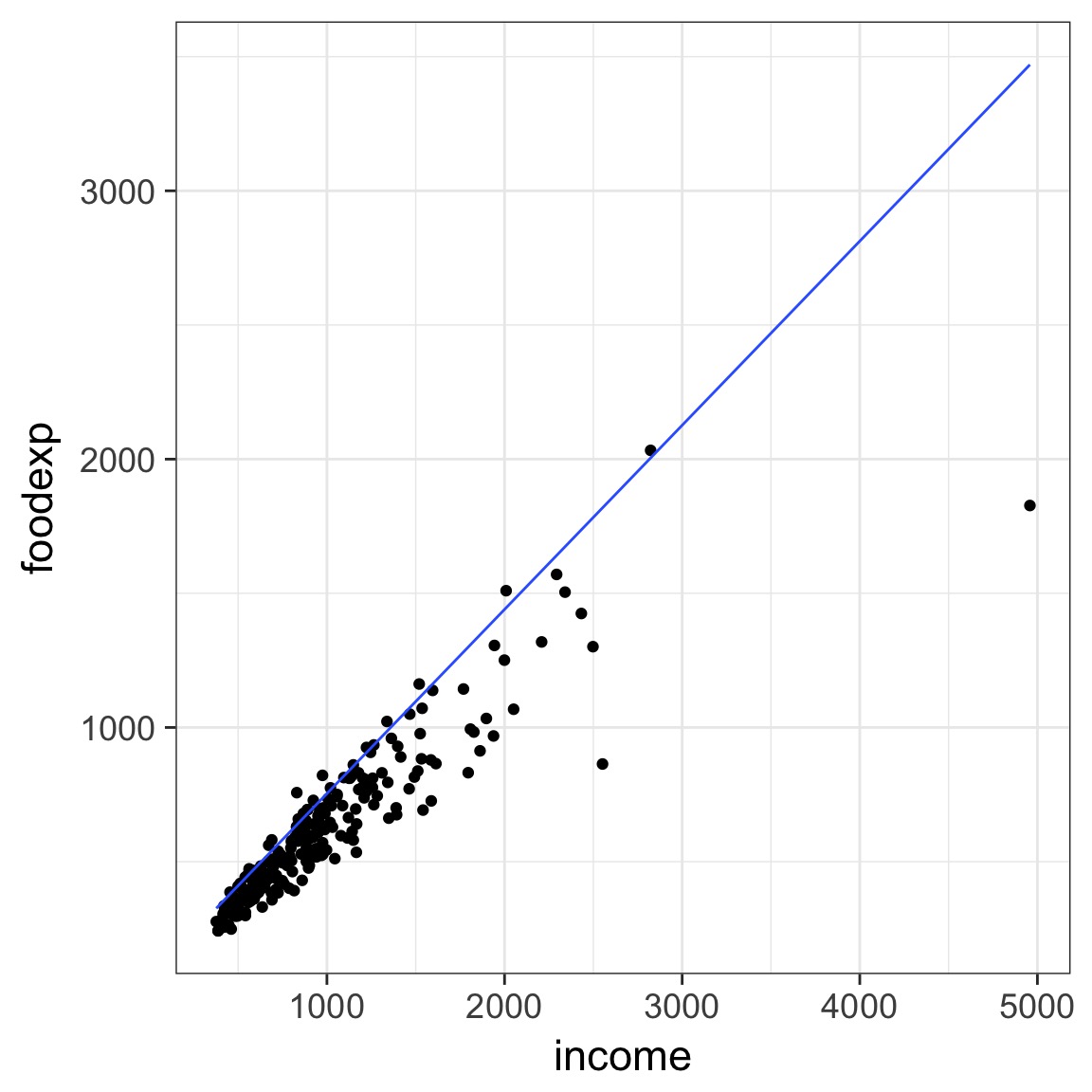

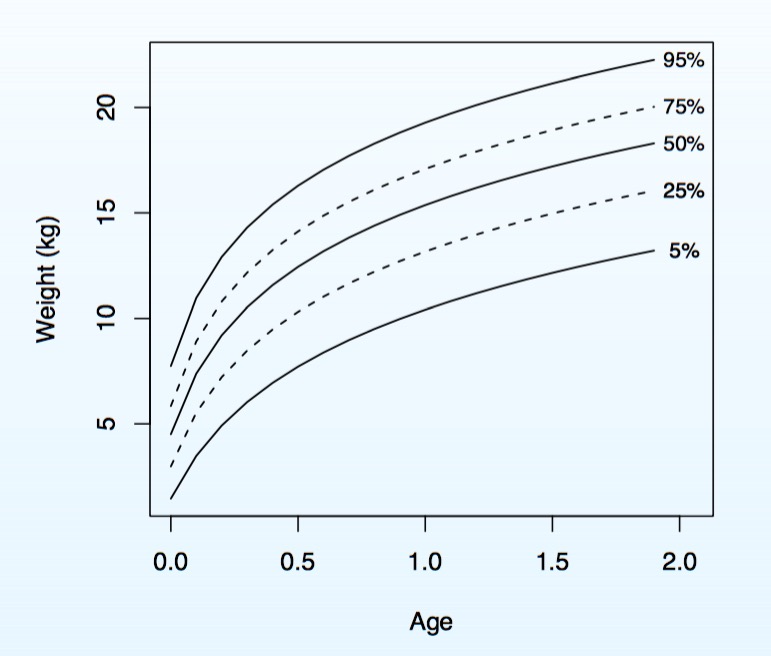

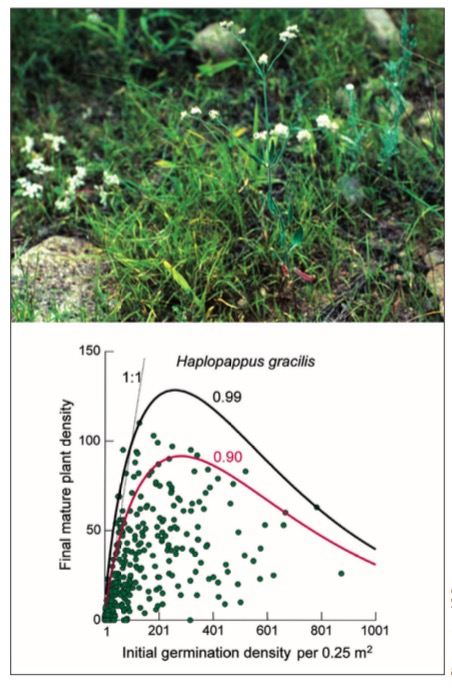

Regression Through a Quantile

- We can fit through other quantiles

- This is the 0.9 quantile

- 90% of the values of y are under the line given X

- This is an optimization problem where residuals are weighted to estimate coefficients

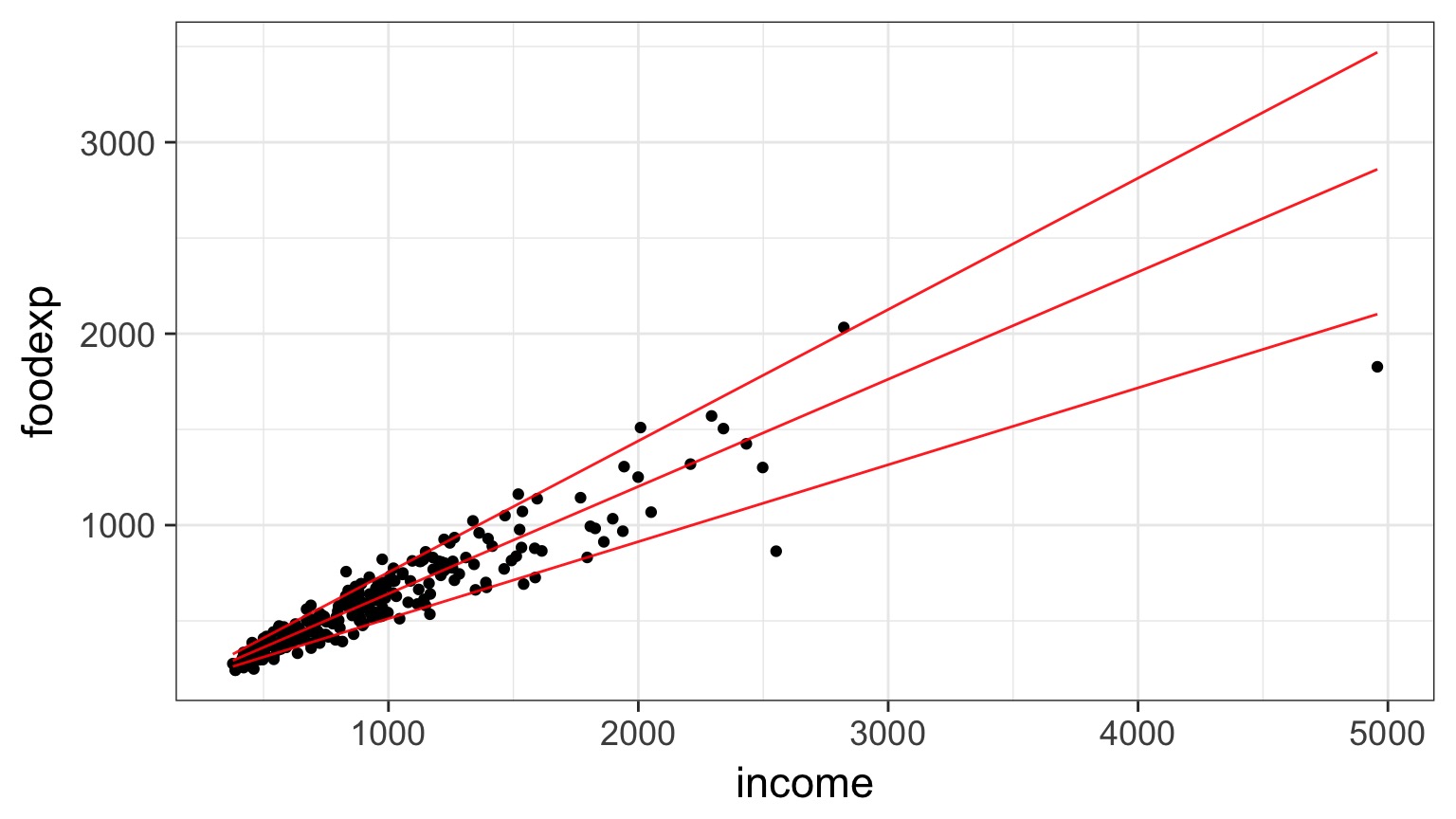

Regression Through Quantiles

Regression Through Quantiles

Quantile Regression and Kiddos

Application Very Flexible

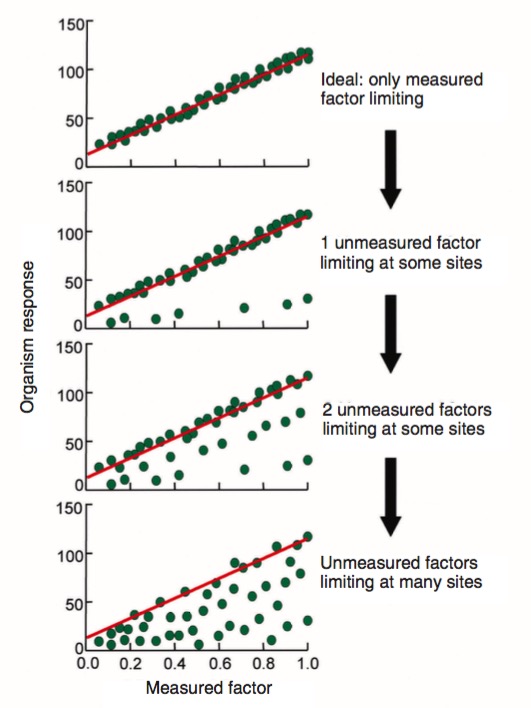

Why Quantile Regression?

- Unequal Variation (the trumpet) implies underlying unmeasured drivers & interactions

- Allows us to see how a relationship varies within a population with no additional covariates

- Allows us to look at constraints on a population

- See Cade and Noon 2003

Why Quantile Regression?

Quantile Regression with Quantreg

Tau = quantiles

library(quantreg)

data(engel)

engel_rq <- rq(foodexp ~ income, data=engel,

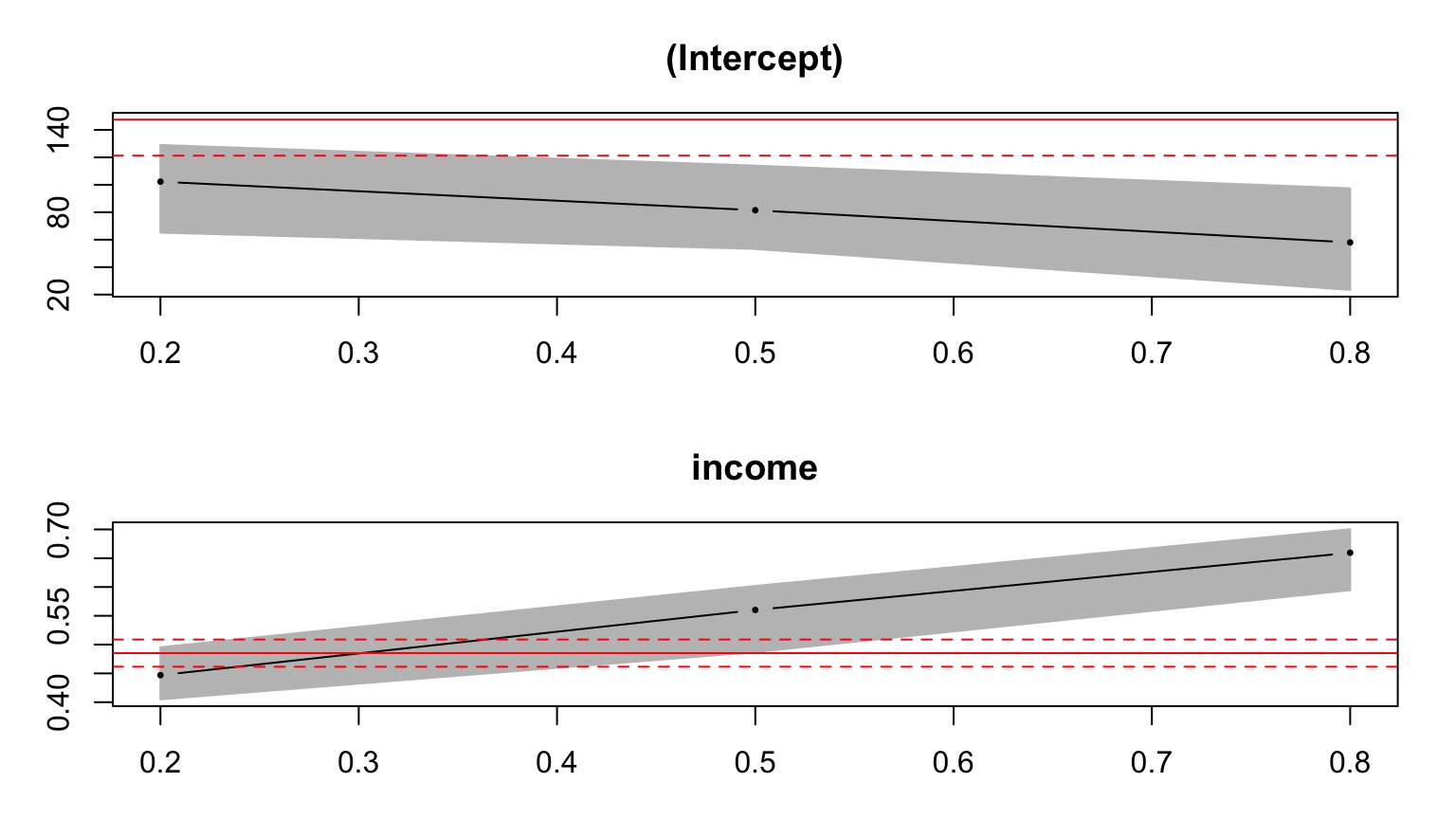

tau = c(0.2, 0.5, 0.8))Quantile Regression with Quantreg

summary(engel_rq)

Call: rq(formula = foodexp ~ income, tau = c(0.2, 0.5, 0.8), data = engel)

tau: [1] 0.2

Coefficients:

coefficients lower bd upper bd

(Intercept) 102.31388 65.20699 129.07170

income 0.44690 0.40492 0.49542

Call: rq(formula = foodexp ~ income, tau = c(0.2, 0.5, 0.8), data = engel)

tau: [1] 0.5

Coefficients:

coefficients lower bd upper bd

(Intercept) 81.48225 53.25915 114.01156

income 0.56018 0.48702 0.60199

Call: rq(formula = foodexp ~ income, tau = c(0.2, 0.5, 0.8), data = engel)

tau: [1] 0.8

Coefficients:

coefficients lower bd upper bd

(Intercept) 58.00666 23.44539 97.44950

income 0.65951 0.59454 0.70049Broom Summary

broom::tidy(engel_rq) term estimate conf.low conf.high tau

1 (Intercept) 102.3138823 60.8322719 136.0809160 0.2

2 income 0.4468995 0.3746126 0.4958588 0.2

3 (Intercept) 81.4822474 47.0904023 135.1883939 0.5

4 income 0.5601806 0.4803301 0.6127786 0.5

5 (Intercept) 58.0066635 18.2035033 111.9660198 0.8

6 income 0.6595106 0.5939093 0.7153737 0.8Plotting Lines

engel_plot <- ggplot(data=engel, aes(x=income, y=foodexp)) +

geom_point() +

theme_bw(base_size=17)

#STAT_QUANTILE

engel_plot +

stat_quantile(quantiles=c(0.2, 0.5, 0.8))Plotting Lines

Plotting Coefficients

plot(summary(engel_rq))

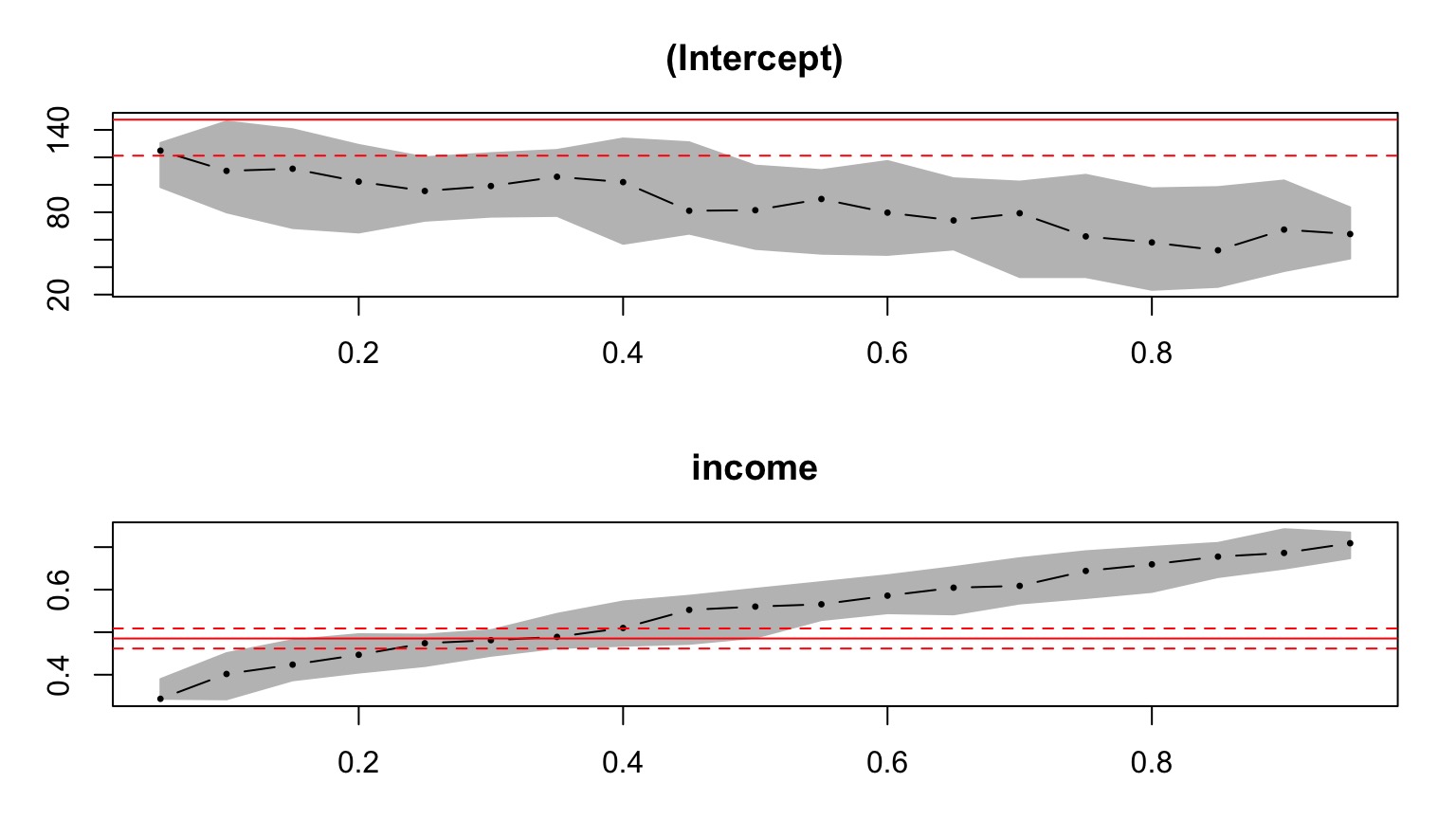

Lots of Coefficients

plot(summary(rq(foodexp ~ income, data=engel,

tau = seq(0.05,0.95,.05))))

Are the Coefficients Equal?

- We might want to know if there are differences between quantiles of the population.

- F-Test

anova(engel_rq)Quantile Regression Analysis of Deviance Table

Model: foodexp ~ income

Joint Test of Equality of Slopes: tau in { 0.2 0.5 0.8 }

Df Resid Df F value Pr(>F)

1 2 703 21.003 1.382e-09 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1Example Data for Today

- ekk_from_dryad.csv from Brennan A, Cross PC, Creel S (2015) Managing more than the mean: using quantile regression to identify factors related to large elk groups. Journal of Applied Ecology

- What if some of the population abundances have been measured with error? E.g. Wolves v. Elk population size?

- Where does Quantile regression come in handy in asking what determines elk herd abundance?